Volunteer Strathcona partners with E4C Alberta and Strathcona County Library to offer the delivery of free tax preparation for low-income Strathcona County residents.

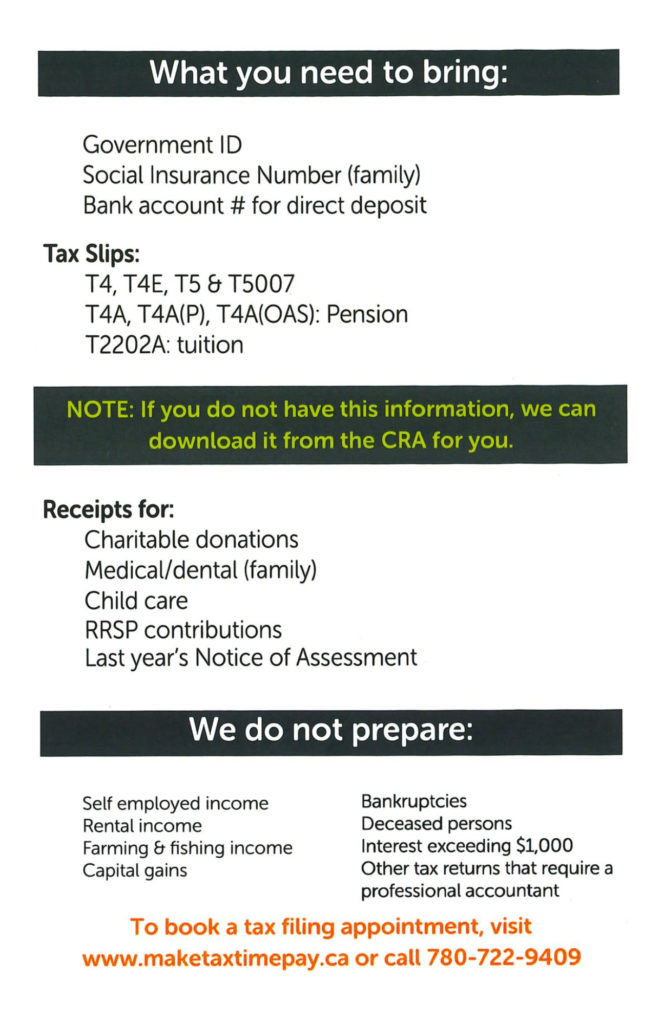

Tax returns must be simple: no specialized or complex tax returns will be considered.

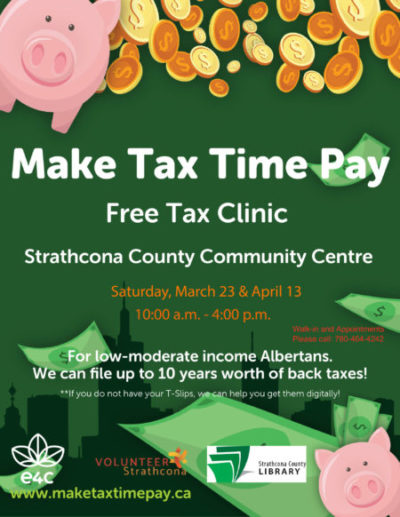

E4C Alberta, Volunteer Strathcona and Strathcona County library will be hosting two Make Tax Time Pay clinics at the Community Centre on March 23 and April 13, 2024 from 10:00 a.m. – 4:00 p.m. in meeting rooms 3 & 4. To book an appointment please call 780-464-4248 starting March 1, 2024. Walk in appointments are also available on the day of the clinics.

If you are unable to make it to the Make Tax Time Pay Clinics, residents wanting a scheduled phone appointment, please call E4C at 780-722-9409, or please register through their website at tax.e4calberta.org

Program runs year-round through E4C, and in-person each Spring.

What should I bring?

- Government Issued ID

- Social Insurance Number (family)

- Bank Account # for Direct Deposit

- Tax Slips:

- T4, T4E, T5 & T5007, T4A, T4A(P), T4A(OAS): Pension, T2202A: Tuition

- Receipts for

- Charitable Donations

- Medical/Dental(Family)

- Child Care

- RRSP Contributions

- Last Year’s Notice of Assessment

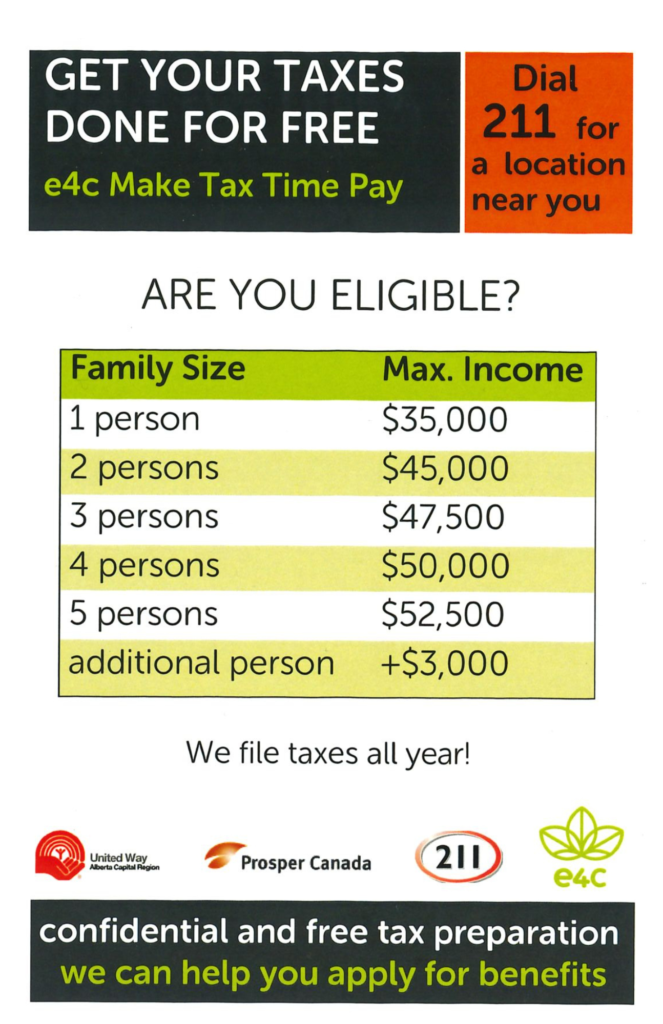

Eligibility Requirements